APRIL

PROPERTY MARKET UPDATE

May 01, 2023

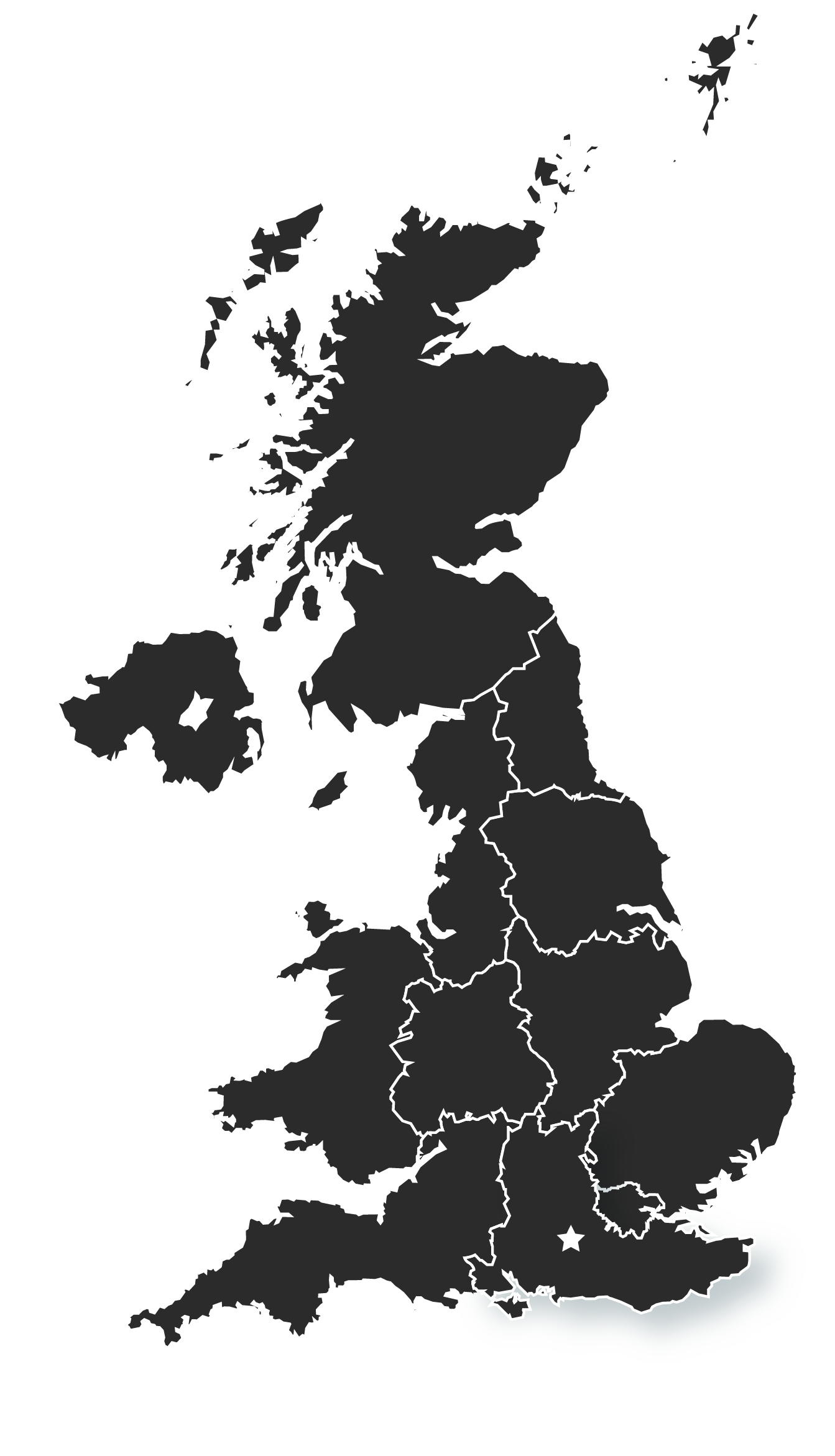

House prices rose again in the UK in April, a monthly change of +0.2% from March making that an annual change of 1.7%. Rightmove commented on the UK being a “more settled market” with Savill’s adding that the market is weighted towards those with cash and equity. That said, it may not be that way for long with mortgage interest rates continuing to fall. We’re seeing clients striking lending deals well below advertised rates, capitalising on the current fierce competition between providers.

What property investors need to know about the UK housing market at the moment.

Industry professionals are reporting a sense of regaining normalcy. Following the desperate times of Covid-19, we're now seeing a more balanced UK market than in years, a healthy end for the year's first quarter. The South East remains the most active region for sales, yet we're seeing pockets of intense demand, such as in Birmingham, where demand far outstrips supply in the new build market.

The South East continues to be a safe bet – but investor opportunities are not limited to here. For example, the boiling rental market pushes tenants further afield than they might have previously considered, driven by price points and disappointment at constantly missing out on rental properties. Savill's April update discussed more expansive commuter areas doing better than the immediate London commuter belt – Cambridge over Esher in Surrey, for example. If you're interested in capitalizing on these future hotspots, see our development of eco-efficient homes in Sudbury Fields near Cambridge with prices from £250,000.

The number of available homes to buy is down a third on pre-pandemic levels. Thus, quality stock is harder to come by than you might think.

The biggest news in April, which could doubt spur further growth in the UK market, particularly London, came from Singapore.

Draconian changes in Singapore will attract more investors to the London market.

Under Singapore’s Additional Buyers Stamp Duty (ABSD), foreign nationals (or non-domestic buyers) paid a higher additional stamp duty of 30%. At the end of April, the Singaporean government announced it would double the tax to 60% - a considerable increase that will no doubt deter investors looking at Singaporean investment property.

The UK, in contrast, remains very much open to international property investors. Savills recently reported on other countries making moves to adopt punitive measures to protect their local markets; Ireland and Portugal both ending their golden visa schemes to ensure greater affordability for local buyers, while Canada has put a hold on purchases by foreign buyers for two years (with some exceptions). Even in the USA, the city of Los Angeles has imposed a new 4% city-wide tax on sales of homes over $5m and 5.5% for $10m.

London and the UK, on the other hand, remain open for business.

More good news for UK property investors and landlords

The UK government has pushed back legislation that required all rented residential properties to be EPC rated ‘C’ and above to 2028, three years later than initially planned, giving landlords further time to get their rental properties compliant. We assure our clients that buying through the RPA Group means we can thoroughly interrogate a property’s EPC rating. We’re working with the best and future-focused developers to bring our clients the most efficient energy-rated properties; it’s simply how the world is moving and a primary consideration investors should consider when looking at property purchases.

New commuter patterns creating new investment hotspots

Finally, Brighton has seen the most significant increase in rail passengers in the UK since the pandemic began, specifically its Preston Park railway station. It topped the charts of the most commutable locations. If you’re looking to capitalize on the new normal that hybrid working enables, look no further than our Brighton development, the Goldstone Apartments, where prices start at £362,450.

With summer approaching, you may be planning a trip to the UK. If you’d like to visit any of our developments, let us know, and our team in the UK can arrange viewings. As ever, we’re here for any questions you have.

The Goldstone Apartments

about the AUTHOR

RICHARD BRADSTOCK

RPA’s founder, Richard has worked in residential development investment for 20 years and oversees the general running of the business ensuring the RPA Group retains true to its founding principles. Over his career Richard has built an incredible network of international property investors and like-minded industry professionals. The RPA Group was born out of a duty of care to provide property investors with an industry-leading and integral service, one that connects investors with quality and desirable investment opportunities, whilst providing reliable and trustworthy market commentary and analysis alongside, enabling investors to make the best, most-educated decisions for them.