UK’s inflation rate dropping and why now is the time to consider buying

November 17, 2023

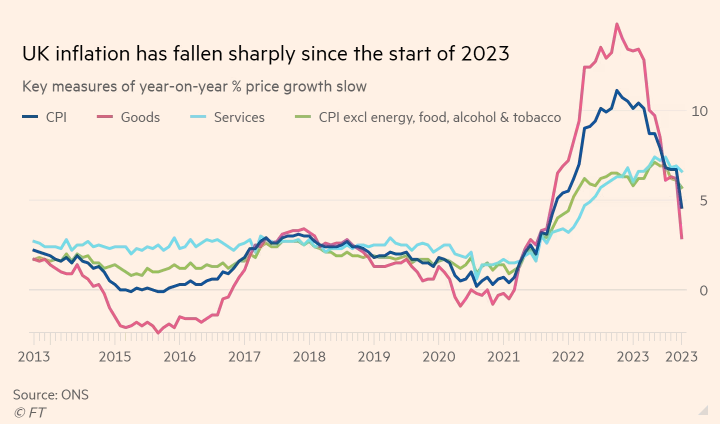

Further good news yesterday as the UK’s inflation rate dropped to 4.6% meaning if you are in the happy position to have cash to invest, there is a significant buying opportunity now.

With financial markets now being fairly firmly behind the idea that the Bank of England has finished raising interest rates (and indeed expected to start cutting rates as early as May 2024) according to the FT, whilst mortgage rates continue to be cut across the board as the UK lenders price wars continue in their efforts to attract new lending - suddenly things are looking a great deal more positive for the UK housing market.

For savvy investors with cash in the bank and an eye for opportunity this is something to note there is a significant buying opportunity.

This returning confidence to the market plus a range of factors (detailed below) has meant that there is a real opportunity to buy UK investment property which will not in all likelihood last that long. These are:

Rents: Rental incomes at an all time high. It is now possible to achieve rental incomes even in London at over 6% (something that quite frankly was impossible even 18 months ago where they would have been round 4-4.5%) and with rents in key locations all over the UK up around 25% over the last 2 years returns everywhere have increased. This has offset the rising mortgage costs and with banks starting to compete on rates it will not be long until the domestic market is back in force.

Access: Domestic transactions in the UK are down thanks to the cost of borrowing. For overseas buyers with access to cash (and utilising a cheap FX rate with the Pound Sterling) developers are now offering product, prices and incentives that simply were not available before as they would have been snapped up locally.

Mortgages: With the mortgage market now in full 'price war' mode as banks cut their margins in a price war to attempt to encourage people to borrow and with the base rate likely to edge down once inflation has been fully tamed, it won’t be long until domestic buyers are buying in large numbers again thereby reducing overseas buyers access.

Price Opportunity: There are prices and incentives to be had today which did not exist previously. Securing an off plan property with a down payment now and handover in 12-24 months will likely mean you are also able to secure a better interest rate than if it was a ready property today whilst accessing an exceptional product at a lower price point.

Therefore the key is to act now. For advice on where, what and how please do feel free to get in touch with the RPA Group as we would be only too pleased to assist in navigating what are still uncertain waters where it is absolutely crucial that you get the right advice. Some that we pride ourselves on.

As a side note for those interested or already with enough UK exposure we have also recently launched an opportunity in Berlin which is well worth a look.

READ OUR PREVIOUS BLOG POST:

RICHARD BRADSTOCK

MANAGING DIRECTOR

about the AUTHOR

RPA’s founder, Richard has worked in residential development investment for 20 years and oversees the general running of the business ensuring the RPA Group retains true to its founding principles. Over his career Richard has built an incredible network of international property investors and like-minded industry professionals. The RPA Group was born out of a duty of care to provide property investors with an industry-leading and integral service, one that connects investors with quality and desirable investment opportunities, whilst providing reliable and trustworthy market commentary and analysis alongside, enabling investors to make the best, most-educated decisions for them.